Key Takeaways About Rent to Own Homes

- Rent-to-own programs provide a pathway to homeownership for those who don't qualify for traditional mortgages by combining renting with an option to purchase.

- Most agreements include an option fee (2-7% of home value) and premium rent payments that contribute toward your future down payment.

- Two main types exist: lease-option (flexibility to walk away) and lease-purchase (legal obligation to buy at term end).

- These programs typically run 1-3 years, giving participants time to improve credit scores and save for down payments.

- Home Ownership Accelerator provides specialized guidance for navigating the complex rent-to-own landscape to ensure successful transitions to homeownership.

The Path to Homeownership When Traditional Methods Fail

The dream of homeownership remains frustratingly out of reach for millions of Americans. With stricter lending requirements, rising home prices, and the challenge of saving for substantial down payments, many find themselves stuck in the rental cycle despite having stable incomes. Rent-to-own programs offer an alternative path that bridges the gap between renting and owning, providing hope for those who can't qualify for traditional mortgages today but could in the near future. These innovative arrangements have helped thousands of families transition from renting to owning on terms that work for their unique financial situations.

At IPPTS Associates, we've guided countless families through the rent-to-own process, helping them overcome barriers that once seemed insurmountable. The beauty of these programs lies in their flexibility and accessibility—they create a structured pathway to homeownership while addressing the very obstacles that keep traditional mortgages out of reach. Whether you're rebuilding credit, saving for a down payment, or simply need more time to prepare for mortgage approval, rent-to-own provides the breathing room many families need.

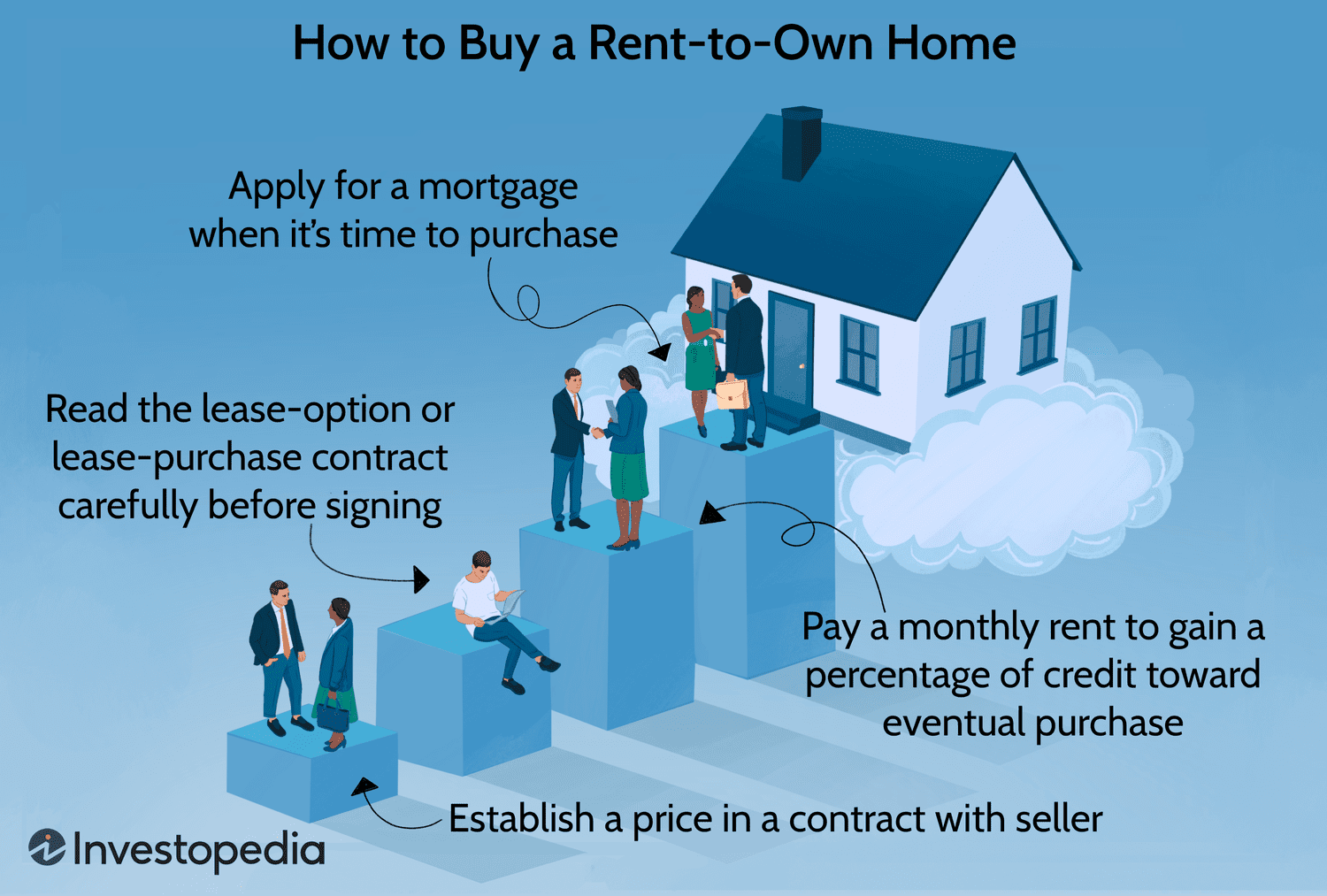

“Rent-to-Own Homes: How the Process Works” from www.investopedia.com and used with no modifications.

What Makes Rent-to-Own Different from Traditional Buying

Traditional home buying requires substantial upfront capital, excellent credit, and immediate mortgage qualification—barriers that exclude many potential homeowners. Rent-to-own flips this model on its head by allowing you to move into your future home today while working toward purchase tomorrow. Instead of requiring perfect financial credentials upfront, these programs give you time to build the necessary financial foundation while already living in your chosen home.

The fundamental difference lies in the structure: rent-to-own splits the homebuying process into stages rather than requiring everything at once. You'll sign two agreements—a lease (like a standard rental) and an option to purchase (giving you the exclusive right to buy the property). Part of your monthly payment typically goes toward your future down payment, helping you build equity before you even own the home. This gradual approach transforms the intimidating leap of homeownership into manageable steps that align with your financial reality.

- Move in with a fraction of what traditional buying requires (typically 2-7% versus 20% down)

- Build equity through premium rent payments while improving credit

- Lock in today's purchase price for a future closing date

- Test-drive the home and neighborhood before fully committing

- Create a structured savings plan toward homeownership

Who Benefits Most from Rent-to-Own Programs

Rent-to-own programs aren't for everyone, but they provide an invaluable lifeline for specific situations. If you're recovering from credit challenges but have stable income, these programs give you time to rebuild your financial profile while working toward homeownership. Similarly, if you're struggling to save for a traditional down payment despite good income, the structured nature of rent-to-own agreements can help you accumulate equity while already living in your chosen home.

First-time homebuyers often find these programs particularly beneficial. The transitional nature eases the psychological and financial adjustment from renting to owning, providing a gentler learning curve for property maintenance and homeownership responsibilities. Self-employed individuals or those with non-traditional income sources—who frequently encounter challenges with conventional mortgage approval despite strong earnings—can use the rent-to-own period to document income stability for future mortgage applications.

Young professionals in growing careers represent another ideal candidate group. If your income is on an upward trajectory but hasn't yet reached its potential, rent-to-own allows you to secure a property today that might otherwise be unattainable for several years. The built-in timeline aligns perfectly with career advancement, potentially positioning you for mortgage approval just as your income reaches the necessary threshold for traditional financing.

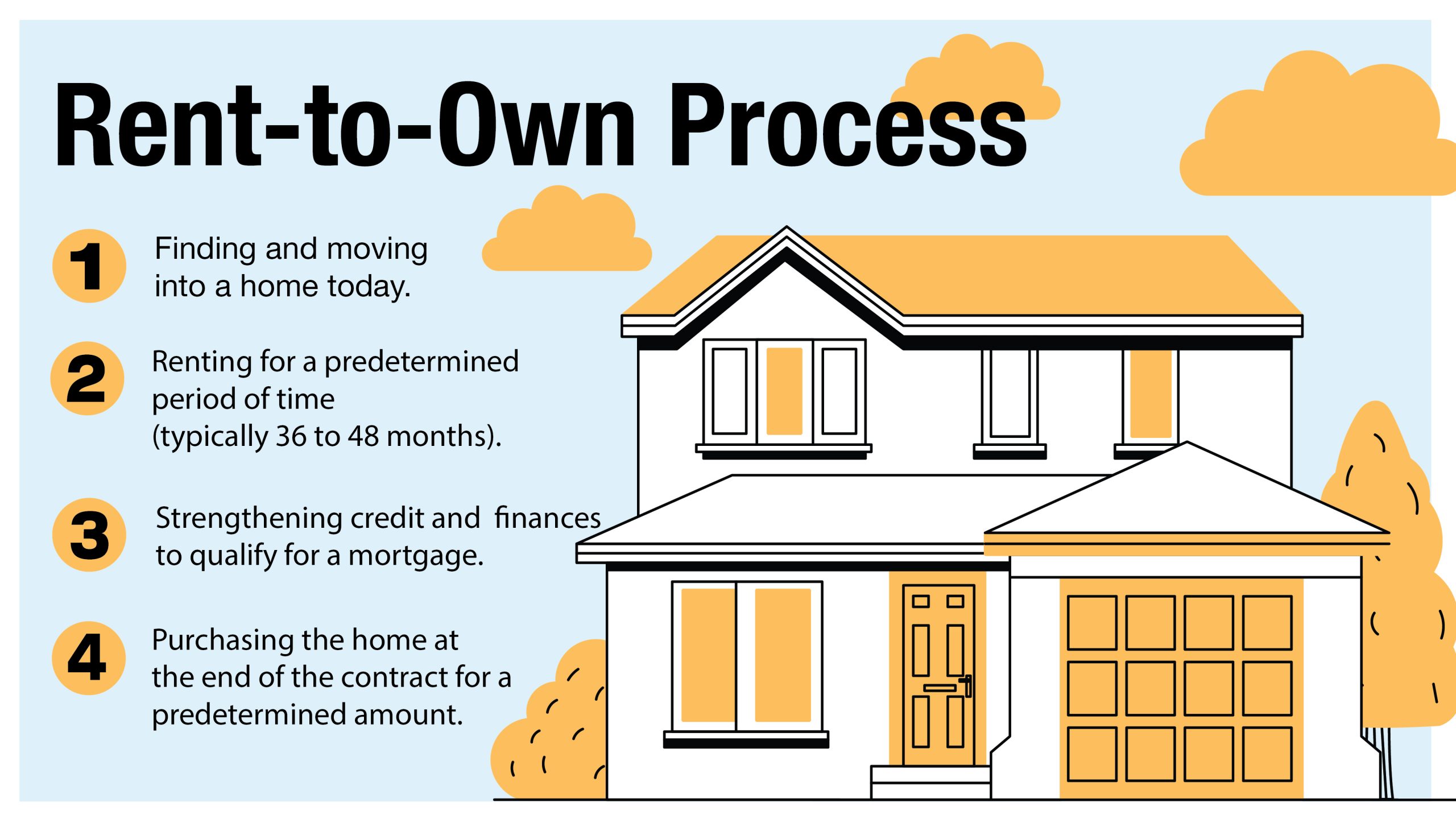

How Rent-to-Own Actually Works: The Real Process

The rent-to-own journey begins with finding the right property and program structure. Unlike traditional rentals or purchases, this hybrid approach requires careful consideration of both current living needs and future ownership goals. The process typically starts with identifying properties specifically offered through rent-to-own arrangements or negotiating such terms with willing sellers. Many specialized agencies and platforms now connect potential buyers with rent-to-own opportunities, streamlining what was once a challenging search process.

“Amazon.com: Rent To Own Homes: Your …” from www.amazon.com and used with no modifications.

Lease Agreement vs. Purchase Option: Understanding Both Parts

Every legitimate rent-to-own arrangement consists of two crucial documents that work in tandem to protect both parties. The lease agreement functions much like a standard rental contract, outlining monthly payment amounts, term length (typically 1-3 years), maintenance responsibilities, and other living arrangement details. This document governs your tenancy rights and obligations during the rental period, providing the same protections traditional renters receive.

The purchase option agreement represents the true differentiator in rent-to-own arrangements. This legally binding document gives you the exclusive right to purchase the property at a predetermined price within a specific timeframe. It details how much of your monthly payment contributes toward your future down payment (often called “rent credits”), the agreed-upon purchase price (or formula for determining it), and the exact process for exercising your option when ready. The option agreement should clearly state whether you have the right to purchase (lease-option) or the obligation to purchase (lease-purchase)—a critical distinction that affects your future flexibility.

Together, these documents create a comprehensive framework that transforms a simple rental into a pathway to ownership. The dual-agreement structure protects your interests as both a current tenant and future buyer, ensuring that your investment in the property remains secure throughout the process. Before signing either document, having them reviewed by a real estate attorney familiar with rent-to-own arrangements can prevent costly misunderstandings and ensure the terms truly support your homeownership goals.

Your Monthly Payments: Where Your Money Goes

In a rent-to-own arrangement, your monthly payments typically exceed standard market rent, but for good reason. This premium isn't simply additional profit for the seller; it represents your gradual investment in your future home. A portion of each payment (often 15-25%) gets credited toward your eventual down payment or purchase price. This rent credit system allows you to build equity while still renting, essentially forcing a savings plan that accumulates over your lease term.

The breakdown of your payment usually includes standard market rent (covering the property owner's carrying costs), the rent premium (your future equity contribution), and sometimes an additional maintenance fee if the agreement shifts certain upkeep responsibilities to the seller during your rental period. Understanding exactly how much of your monthly payment contributes to your future purchase is critical—this should be clearly documented in your agreement with a running total maintained throughout the lease term. For more tips on maintaining a comfortable living space, check out our living area rug guide.

Some programs offer escalating rent credits, where the percentage applied toward your purchase increases the longer you rent. This incentivizes completing the purchase and rewards your consistent payment history. Always request a monthly statement showing your accumulated credits to ensure proper tracking and avoid disagreements when exercising your purchase option. For more insights on making informed purchase decisions, check out this generator purchase guide.

“What is Rent-to-Own Housing? – JAAG …” from jaagproperties.com and used with no modifications.

Option Fees Explained: What You're Really Paying For

The option fee represents your initial investment in securing the exclusive right to purchase the property later. Typically ranging from 2-7% of the home's value, this upfront payment demonstrates your serious intention and provides the seller compensation for taking their property off the market. Unlike a security deposit, the option fee usually applies directly toward your eventual down payment if you complete the purchase—making it an investment rather than an expense.

Think of the option fee as “buying time” to improve your financial situation while locking in today's purchase price. In appreciating markets, this alone can create substantial equity before you even exercise your option. The size of your option fee often correlates with the amount of flexibility in your agreement—larger fees typically secure more favorable terms like longer option periods or higher rent credit percentages.

While option fees are generally non-refundable if you choose not to purchase, some agreements include partial refund provisions under specific circumstances. Negotiating these contingencies upfront provides valuable protection against future uncertainties. Remember that the option fee's primary purpose is to secure your exclusive purchase rights—it represents the price of opportunity rather than a sunk cost.

Purchase Price Determination: Protecting Your Investment

How the future purchase price gets established represents one of the most crucial elements of any rent-to-own agreement. The two primary approaches include setting a specific price at contract signing or establishing a formula for determining the price when you exercise your option. Fixed-price agreements provide maximum certainty but may require paying a premium over current market value to account for anticipated appreciation. Formula-based pricing typically involves an independent appraisal at the option exercise date, sometimes with predefined adjustment factors.

The ideal approach depends largely on market conditions and your specific situation. In rapidly appreciating markets, locking in a purchase price today can create substantial built-in equity by your purchase date. Conversely, in declining or unpredictable markets, formula-based pricing with protective caps might better serve your interests. Whichever method you choose, ensure the agreement clearly outlines the exact process, leaving no room for interpretation or dispute.

Remember that your negotiating leverage is strongest before signing the initial agreement. Including price ceiling provisions or requiring seller-paid inspections at both the beginning and end of the lease term can protect against unforeseen issues. Some agreements even include provisions that adjust the purchase price downward if significant maintenance issues emerge that weren't disclosed initially.

Types of Rent-to-Own Programs Available Today

The rent-to-own landscape has evolved significantly in recent years, offering diverse program structures to match different financial situations and homeownership goals. Understanding the distinct advantages and limitations of each approach allows you to select the program that best aligns with your specific needs. From traditional seller-direct arrangements to innovative third-party facilitation models, today's options provide unprecedented flexibility for aspiring homeowners.

1. Lease-Option Agreements: Maximum Flexibility

Lease-option agreements represent the most flexible rent-to-own arrangement, giving you the right—but not the obligation—to purchase at the end of your lease term. This approach provides a valuable safety net if your financial situation changes or you discover issues with the property during your rental period. You essentially secure the exclusive opportunity to buy without legally committing to the purchase, allowing you to walk away by forfeiting only your option fee and rent credits if circumstances dictate.

The flexibility of lease-options makes them ideal for those with uncertainty about future plans or concerns about qualifying for financing. They provide breathing room to improve credit, save for additional down payment funds, or simply confirm that the property and neighborhood truly meet your long-term needs before fully committing. However, this flexibility typically comes at a cost—lease-option arrangements generally command higher option fees and monthly premiums than their lease-purchase counterparts.

From the seller's perspective, lease-options carry more uncertainty, which explains the premium pricing. The seller must prepare for both potential outcomes: your decision to purchase or your choice to walk away. This dual preparation often translates to more stringent qualification requirements for entering lease-option agreements compared to lease-purchase arrangements.

2. Lease-Purchase Agreements: The Committed Approach

Unlike the flexibility of lease-options, lease-purchase agreements legally obligate both parties to complete the transaction at the end of the lease term. This binding commitment provides stronger assurance for sellers, often resulting in more favorable terms for buyers—including lower option fees, reduced monthly premiums, and sometimes more competitive purchase prices. The certainty of completion allows sellers to make definitive future plans, creating incentives to offer better terms in exchange for your guaranteed purchase.

The primary downside of lease-purchase arrangements is their inflexibility. If you cannot secure financing when the lease expires, you risk breaching the contract, potentially facing legal consequences and losing your entire investment. This makes lease-purchases appropriate primarily for those with high confidence in their ability to resolve credit issues or achieve necessary savings goals within the specified timeframe. Some agreements include limited exit clauses for specific circumstances like job relocations or major health issues, but these exceptions are narrowly defined.

“Rent To Own Homes” from www.teamtrianglerealty.com and used with no modifications.

3. Seller Financing Options: Cutting Out the Middleman

Seller financing represents a direct pathway to ownership without traditional lender involvement, where the property owner essentially becomes your mortgage holder. In these arrangements, you typically make a down payment and then regular installment payments directly to the seller under a formal promissory note and mortgage or land contract. This approach eliminates the need to qualify for bank financing, making it accessible to those with credit challenges that might take years to resolve.

The greatest advantage of seller financing lies in its simplicity—no bank approval process, lower closing costs, and flexible terms negotiated directly between buyer and seller. For sellers with free-and-clear properties (no existing mortgage), this arrangement can generate reliable monthly income while providing you immediate homeowner status. Unlike traditional rent-to-own, seller financing typically transfers actual ownership at the beginning of the agreement, giving you full control over the property while making payments.

However, seller financing arrangements require careful structuring to protect both parties' interests. The higher risk profile for sellers generally results in higher interest rates than conventional mortgages, and balloon payment requirements (where a large final payment comes due after a set period) are common. These balloon provisions often require refinancing with traditional lenders after establishing payment history and improving credit—essentially creating a bridge to conventional financing.

4. Rent-to-Own Clubs and Membership Programs

A newer innovation in the homeownership landscape, rent-to-own clubs and membership programs create structured pathways to ownership through institutional partnerships rather than individual seller arrangements. These programs typically involve professional real estate investment companies that purchase properties specifically for rent-to-own transactions, offering standardized contracts, transparent terms, and dedicated support systems throughout the process. Unlike traditional seller-driven arrangements, these programs provide consistent inventory across multiple markets and price points.

Finding Legitimate Rent-to-Own Properties

The surge in rent-to-own popularity has unfortunately attracted predatory operators alongside legitimate opportunities. Finding reputable programs requires careful research, verification, and often professional guidance. Start by exploring established rent-to-own platforms that screen both properties and sellers, providing standardized agreements and transparent fee structures. Local real estate agents with specific rent-to-own experience can also identify legitimate opportunities and help negotiate favorable terms tailored to your situation.

Red Flags That Scream “Scam”

Protecting yourself from rent-to-own scams starts with recognizing warning signs that differentiate legitimate opportunities from predatory arrangements. Unusually low option fees or no credit check requirements often mask schemes designed to collect rental income without any intention of facilitating eventual ownership. Similarly, verbal promises without comprehensive written agreements almost always indicate problematic arrangements that won't withstand legal scrutiny when complications arise.

Pressure tactics that rush you into signing without proper inspection or review time represent another common red flag. Legitimate programs encourage thorough property inspection, title research, and agreement review by your attorney. Any seller resistant to these basic protections likely has something to hide. Additionally, be wary of agreements lacking specific details about purchase price determination, rent credit calculations, or maintenance responsibilities—these ambiguities create fertile ground for future disputes.

Common Rent-to-Own Scams to Avoid

- Equity Stripping: Programs designed to collect substantial upfront fees and premium rents without realistic paths to financing approval

- Title Problems: Properties with undisclosed liens, pending foreclosures, or ownership disputes that prevent clean title transfer

- Balloon Maintenance: Deferred maintenance deliberately hidden until purchase time, creating unexpected repair costs

- Phantom Credits: Agreements that promise rent credits but include fine print clauses that nullify them for minor lease violations

- Moving Target Pricing: Vague purchase price formulas that allow sellers to manipulate final costs beyond reasonable market values

Perhaps the most deceptive practice involves properties with significant title problems that make eventual purchase impossible regardless of your payment history. Before entering any agreement, invest in a preliminary title search to verify the seller's legal right to transfer the property and identify any existing liens or encumbrances. Similarly, hire a professional home inspector to document the property's current condition, establishing a baseline for future comparison when you exercise your purchase option.

Some scammers specifically target vulnerable populations with limited housing options due to credit challenges or income documentation issues. These predatory operators charge excessive option fees and monthly premiums while deliberately structuring agreements to maximize the likelihood of tenant default. They profit from repeated cycles of tenant failure, collecting new option fees and premium rents from each subsequent victim without ever transferring ownership. It's important to be aware of such scams and understand how to verify authenticity to avoid falling prey to deceptive practices.

Essential Contract Terms to Protect Your Rights

A well-crafted rent-to-own contract provides clear protection for both parties and eliminates ambiguity about key terms. Start with explicit language about the purchase price (or precise formula for determining it) and exactly how much of each monthly payment applies toward your future purchase. The agreement should clearly state whether you have the option or obligation to buy, along with specific timeframes for exercising your purchase rights.

Maintenance responsibilities represent another critical contractual area requiring precise language. Unlike traditional rentals where landlords handle most repairs, rent-to-own agreements often shift some maintenance to tenants as “future owners.” Your contract should categorize repair responsibilities by type and cost threshold, detailing exactly who handles what during the rental period. Include provisions for how major unexpected repairs (like HVAC failure or roof damage) affect the purchase process and price.

Property condition documentation provides essential protection against future disputes. Require professional inspection reports at both the beginning and end of the lease term to establish objective evidence of the property's condition. Similarly, title verification language should require the seller to deliver clear title at closing and disclose any existing liens, encumbrances, or restrictions that might affect future ownership.

Working with Licensed Professionals vs. Going Solo

The complexity of rent-to-own transactions makes professional guidance particularly valuable throughout the process. A real estate attorney with specific experience in rent-to-own contracts can identify problematic clauses, ensure proper protection of your interests, and verify that the agreement complies with local laws. Their upfront cost typically pales in comparison to the financial protection they provide against common pitfalls.

Licensed real estate agents specializing in rent-to-own transactions offer another layer of protection, particularly during the property selection and negotiation phases. Their market knowledge helps ensure the agreed-upon purchase price aligns with actual property values, while their experience with these specialized transactions can identify red flags invisible to the untrained eye. Many specialized agents maintain relationships with lenders experienced in working with rent-to-own clients, smoothing the eventual transition to traditional financing.

While the DIY approach might seem cost-effective initially, the financial stakes and legal complexities of rent-to-own arrangements generally justify professional involvement. These transactions contain numerous potential pitfalls for uninformed participants, from appraisal issues to title problems to contractual loopholes. The modest investment in professional guidance typically yields substantial returns in both financial protection and peace of mind.

Building Your Financial Foundation During the Rental Period

The rental period in a rent-to-own agreement represents your critical window for financial preparation—the time to transform your credit profile, savings position, and overall financial health to ensure mortgage approval when your purchase option matures. This preparation requires deliberate strategy rather than passive waiting, with focused effort across multiple financial dimensions. The most successful rent-to-own participants treat this period as active preparation rather than simple rent payment.

Credit Repair Strategies for Future Mortgage Approval

Credit improvement begins with understanding your current profile through comprehensive reports from all three major bureaus. Identify and dispute any inaccuracies, focusing particularly on derogatory items that most heavily impact mortgage approval. Pay special attention to credit utilization ratios—keeping revolving accounts below 30% of available credit significantly improves scores, with even greater benefits at lower utilization levels.

Establish perfect payment history across all accounts during your rental period, as recent history carries greater weight than past issues. Consider adding positive tradelines through secured credit cards or credit-builder loans if your profile lacks account diversity. Some rent-to-own programs now report your on-time rent payments to credit bureaus, creating additional positive history that strengthens your profile specifically for mortgage applications.

Most importantly, avoid new credit inquiries and account openings in the months preceding your mortgage application. These activities can temporarily depress scores and raise red flags for underwriters. Instead, focus on stabilizing existing accounts and demonstrating consistent, responsible credit management throughout your rental period.

Saving for Your Down Payment While Renting

While rent credits contribute toward your future down payment, most rent-to-own participants need additional savings to complete their purchase. Create a dedicated savings plan that accounts for closing costs (typically 2-5% of the purchase price) beyond the down payment itself. Many successful participants automate bi-weekly transfers to dedicated accounts, creating forced savings that accumulate alongside their rent credits.

Consider supplemental income sources specifically earmarked for your homeownership fund. Whether through side gigs, overtime opportunities, or selling unused items, these dedicated funding streams can substantially accelerate your savings timeline. Some participants temporarily reduce retirement contributions (while maintaining any employer match) to redirect funds toward their more immediate homeownership goal.

Explore down payment assistance programs available in your area, as many remain accessible even in rent-to-own situations. State housing finance agencies, local government programs, and non-profit organizations often provide grants or favorable loans that can bridge funding gaps. Begin researching these resources early, as many programs require advance application and approval before your purchase option window opens.

Documenting Your Payment History for Lenders

Mortgage underwriters require clear evidence of payment stability, making meticulous documentation of your rent-to-own payments essential for eventual financing approval. Maintain copies of all canceled checks, electronic payment confirmations, and receipts throughout your rental period. Request periodic written statements from your seller confirming your payment history and accumulated rent credits, especially if payments aren't made through formal property management systems.

Beyond basic payment records, document any property improvements or maintenance you perform during the rental period, particularly if your agreement allocates certain responsibilities to you as the tenant-buyer. These records demonstrate your investment in the property and can influence appraisal values when you apply for financing. Similarly, maintain records of property tax payments, insurance coverage, and any other housing-related expenses that demonstrate your responsible property management.

Begin establishing relationships with mortgage lenders well before your purchase option matures. Many offer pre-qualification reviews that identify specific documentation needs based on your unique situation, allowing you to address potential issues before they become obstacles. Some specialized lenders even offer future approval programs that provide conditional mortgage commitments based on meeting specific credit improvement and savings milestones during your rental period.

Making the Transition from Renter to Owner

The culmination of your rent-to-own journey occurs when you exercise your purchase option and formally transition from tenant to owner. This critical phase requires careful timing, thorough preparation, and strategic execution to ensure smooth property transfer. Begin preparing for this transition at least six months before your option window opens, allowing sufficient time to address any unexpected obstacles that emerge.

Your formal transition begins by providing written notice of your intent to exercise your purchase option, following exactly the notification requirements specified in your agreement. This communication typically triggers a sequence of events including formal appraisal (if required), title search, and financing application. Following precise contractual procedures during this phase protects your legal rights and prevents potential disputes about whether you properly exercised your option.

When to Exercise Your Purchase Option

Timing your purchase option exercise involves balancing multiple factors including market conditions, interest rate environments, and your personal financial readiness. Most agreements specify an option window rather than a single date, giving you flexibility to select the optimal timing within that period. Monitor both local real estate trends and mortgage rate forecasts as your window approaches, positioning your purchase during favorable market conditions whenever possible.

Consider exercising your option early if interest rates are rising, as rate increases can significantly impact your monthly payment and total ownership costs. Conversely, in declining real estate markets, waiting until later in your option window might provide negotiating leverage for price adjustments if your agreement includes market-based pricing components. Your personal financial situation—particularly your debt-to-income ratio and available cash reserves—should ultimately drive your timing decision, ensuring you're in the strongest possible position when submitting your mortgage application.

Securing Financing at the End of Your Lease Term

Begin your formal mortgage application process at least 90 days before you plan to exercise your purchase option, allowing ample time for underwriting, appraisal, and addressing any conditions placed on your approval. Submit complete documentation packages including your rent payment history, accumulated rent credits, employment verification, and all other financial information requested by your lender. The strength and completeness of your initial application package significantly influences both approval likelihood and processing speed.

What Happens If You Can't Buy When the Lease Ends

Despite careful planning, circumstances sometimes prevent successful purchase completion when your lease term expires. If you face this situation, your options depend largely on your specific agreement type and the relationship you've developed with the seller. Lease-option agreements typically allow you to walk away without further obligation beyond forfeiting your option fee and rent credits, while lease-purchase agreements may involve more complicated legal consequences for non-completion.

When financing obstacles arise, consider requesting an extension of your option period to resolve specific issues identified by lenders. Many sellers will accommodate reasonable extension requests if you've maintained perfect payment history and demonstrated good-faith efforts toward purchase completion. Some may consider alternative financing arrangements like seller carry-backs or contract-for-deed options that bridge temporary approval gaps while providing them continued financial return.

| Option Type | If You Can't Buy | Potential Solutions |

|---|---|---|

| Lease-Option | Forfeit option fee and rent credits, move out | Request extension, negotiate new terms, explore seller financing |

| Lease-Purchase | Potential legal liability for breach of contract | Negotiate settlement, request specific performance release, arrange assignment |

| Third-Party Program | Varies by program (check contract terms) | Program extensions, buyout options, credit transfers to new property |

If continuation proves impossible, focus on documenting all good-faith efforts toward purchase completion and negotiating the most favorable exit terms possible. Some agreements include partial credit refunds under specific circumstances like lender rejection despite meeting pre-established qualification benchmarks. Others allow assignment of your purchase rights to qualified buyers who can complete the transaction, potentially recovering some of your accumulated investment.

Your Next Steps: Starting Your Rent-to-Own Journey

Begin your rent-to-own journey by honestly assessing your current financial situation and establishing clear homeownership timelines. Identify the specific obstacles preventing traditional mortgage qualification now, then develop structured plans to address each barrier during your rental period. Connect with specialized real estate professionals familiar with rent-to-own transactions in your target market, focusing particularly on agents and attorneys with demonstrated experience in these specialized arrangements. Home Ownership Accelerator can connect you with trusted professionals who understand the unique challenges and opportunities these programs present, helping you navigate the path to successful homeownership.

Frequently Asked Questions

Navigating the rent-to-own landscape generates common questions from prospective participants. These frequently asked questions address the most common concerns about program structure, financial requirements, and practical considerations for successful participation.

How much money do I need upfront for a rent-to-own program?

Most rent-to-own programs require an upfront option fee ranging from 2-7% of the property's purchase price. This fee secures your exclusive right to purchase and typically applies toward your down payment when you exercise your option. Additional upfront costs may include first month's rent, security deposit, and sometimes a home inspection fee. The total initial investment generally ranges from 3-10% of the property value depending on program structure, local market conditions, and your negotiating position.

Can I lose my option fee if I decide not to buy the property?

Yes, option fees are typically non-refundable if you choose not to exercise your purchase option. This fee compensates the seller for removing the property from the market and providing you exclusive purchase rights. However, some agreements include partial refund provisions under specific circumstances like major property defects discovered during your rental period or substantial job relocations beyond commuting distance. When negotiating your agreement, consider including conditional refund clauses that protect against circumstances beyond your control.

Who handles repairs and maintenance during the rental period?

Maintenance responsibility varies significantly between rent-to-own agreements and should be explicitly detailed in your contract. Traditional arrangements often assign day-to-day maintenance to the tenant-buyer while keeping major structural and system repairs with the seller. This division acknowledges your “future owner” status while protecting you from catastrophic expenses before you hold title.

More tenant-favorable agreements include expenditure thresholds, where you handle minor repairs below a certain dollar amount (typically $250-500) while the seller remains responsible for more substantial issues. The most important factor isn't the specific division of responsibility but rather the clarity of the agreement terms, eliminating ambiguity about who handles which repairs and how maintenance affects the eventual purchase transaction.

What credit score do I need for a rent-to-own program?

Unlike traditional mortgages with rigid credit score requirements, rent-to-own programs offer flexibility based on your overall financial picture and future improvement potential. Many programs accept scores as low as 580-600 for entry, focusing more on recent payment history and income stability than past credit challenges. The most important factor isn't your current score but rather your demonstrable ability to reach conventional mortgage qualification thresholds (typically 620-640 minimum) by the end of your lease term. Programs that include credit counseling and monitoring services offer particularly valuable support for participants focused on score improvement.

Can I negotiate the purchase price in a rent-to-own agreement?

Absolutely—purchase price negotiation represents one of the most critical aspects of any rent-to-own agreement. Fixed-price agreements should reflect fair current value plus reasonable anticipated appreciation based on local market trends. Many buyers successfully negotiate purchase prices 1-3% below current market value in exchange for their substantial commitment to the property. Alternative approaches include setting caps on appreciation percentages, establishing price determination formulas based on independent appraisals, or including adjustment mechanisms tied to documented property condition changes during your rental period.

Understanding your local market conditions provides essential context for effective price negotiation. In rapidly appreciating markets, sellers typically command premium pricing to account for substantial value increases during your rental period. Conversely, in stable or uncertain markets, you gain negotiating leverage by offering the seller guaranteed future sale certainty in exchange for more favorable pricing terms. For those dealing with property issues, such as a mold testing kit, understanding these dynamics can be crucial.

Remember that every aspect of a rent-to-own agreement remains negotiable before signing—from purchase price to rent credit percentages to maintenance responsibilities. The most successful participants approach these negotiations with clear understanding of both market conditions and their own financial capabilities, creating agreements that truly serve their long-term homeownership goals.

At the Rent To Own Club, they specialize in helping aspiring homeowners navigate the complex rent-to-own landscape to find programs that match their unique situations and goals.

Contact us today to explore how our specialized guidance can help transform your homeownership dreams into reality through the right rent-to-own program.